SAP S/4HANA Central Finance (CFIN) Scenarios:-

One of the major goals of a finance unit in any company is to publish its shareholders on a timely basis every year analysis consolidated financial statement. This is the most difficult moment for financial teams in any organization, as many tasks have to be completed within a restricted time frame with 100 percent precision. Identified solutions, such as Hyperion, have been available to organizations for more than a decade to achieve consolidation functions. Nowadays, the development of business goals demands high quality in almost continuously every function of the organization. Organizations have already moved or are moving into new operational models such as centralized shared services to leverage better IT solutions and availability of telecom infrastructure.

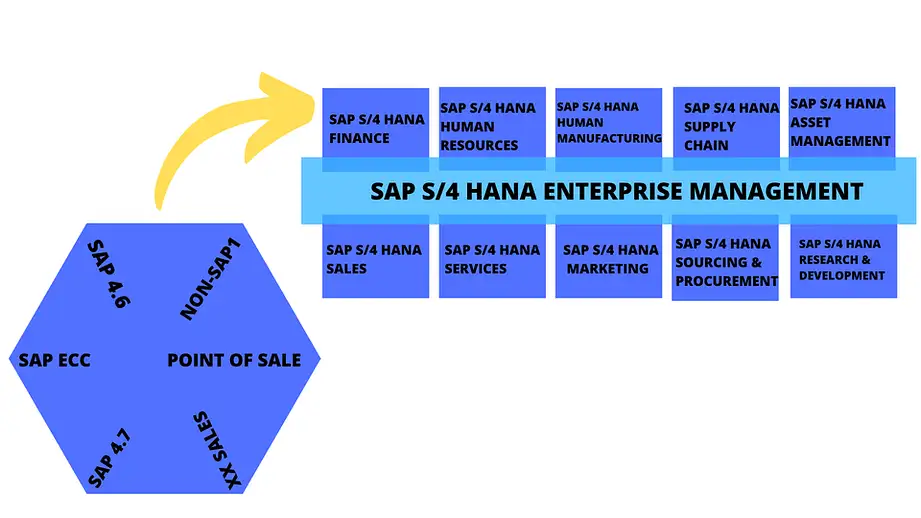

SAP S/4HANA Central Finance (CFIN) is an innovative solution that addresses in real-time the need for organizations to consolidate and centralize those tasks. Our blog helps for Solution Architects and Strategy Specialists gain an overview of SAP Central Finance, required approaches for adopting Central Finance and new centralization functions that can utilize Central Finance as a pivot and add value to clients. SAP Central Finance is an SAP S/4HANA system that can be a self-governing instance that receives real-time commercial actions from SAP or non-SAP structures via reproduction networks. Using Central Finance has many advantages. It offers real-time transaction planning and acquisition. In addition to sourcing ERP systems, it promotes optimized local as well as central system execution. It enables clients to use sophisticated data architecture in finance such as “Universal Journal. Organizations often have legacy SAP cases, such as SAP ECC or even SAP 4.x, as well as non-SAP systems and some reference approaches. Migrating from these systems to SAP S/4 HANA could be an enormous challenge to them. This is one scenario where SAP Central Finance can assist. Let’s see beneath main usage instances.

Central Finance Cases:-

There are instances of common use where Central Finance can provide creative alternatives:

- As an S/4 HANA migration path

- To centralize methods throughout the organization

- During Re-organisation and/or Mergers For consolidation and reporting of companies

As an S/4 HANA migration path:-

There are many cases of SAP and Non-SAP alternatives in the present client landscape. The expense and commitment engaged in finishing an exercise survey of Business Process Re-engineering and implementing a centralized solution to substitute all of the “island alternatives” using the “Big Bang” strategy. Competition in the business, however, does not offer good enough time or facilities for the organization to conduct such a huge activity. In order to remain on the market and gain momentum to create a smart business, it is essential to embrace innovations available in S/4HANA in a fast and agile way. A separate greenfield application of SAP S/4HANA Central Finance is carried out at commercial headquarters, keeping current cases and schemes as they are.

By creating the required links for chosen financial, billing, and company scheduling situations from current instances/systems, real-time information streams into Central Finance. This enables the group to reach rapid results, learning “on-the-go” S/4 HANA design and technologies, and working back on re-engineering current procedures. This operates in real-time, particular to their setting, as a proof of concept. This strategy enables organizations to acquire understanding and moment and schedule in a continuous way to migrate current technologies to S/4HANA.

To centralize methods throughout the organization

This operates in real-time, particular to their setting, as a proof of concept. This strategy enables organizations to acquire understanding and moment and schedule in a continuous way to migrate current technologies to S/4HANA.

Due to Re-organisation and/or Mergers:

Business requirements may lead companies to forge alliances with other organizations or sometimes, for example, to reorganize their current operations by splitting them into multiple product categories. Central Finance can attach to such method integration systems without interrupting existing IT structures and reveal centralized financial data. It depends, however, on several various factors for each position.

For Corporate Consolidation and Reporting:

Major companies with various branches or various manufacturing/sales locations have to regularly strengthen their financial performance to monitor and comply with statutory and legal regulatory requirements. Data processing and compilation is an operation that is somewhat time-intensive and vulnerable to mistakes. Central Finance can easily integrate into a variety of systems and provide the necessary control and accurate information on a timely basis.

Here are some of the current centralization features that can bolt Central Finance and give more value to clients.

1. Transactions centralized:

SAP Central Finance’s centralized transaction feature lets an organization make payments from high-density areas, usually corporate headquarters, or conduct coordinated clearance operations instead of needing to do so in various places. When the invoices submitted in the source technologies are enabled, they are theoretically removed and reproduced to the Central Finance system and compensated there. Credit administrators are associated with this, which can be triggered in Central Finance. If done, reference checks will be initiated in the local system (at the arrival of the marketing order) and performed in Central Financial Services. It is also possible to install cash and cash flow strategic planning in the Central Finance system. This is an essential function to achieve investment management productivity, usually a mandate in several larger companies.

2. Reporting by organizations:-

SAP S/4HANA’s “Team Accounting” feature includes management monitoring features, team accounting through promoting data quality assurance systems, integration system control, and monitoring. The SAP application component is – FIN-CS (Group Reporting SAP S/4HANA). SAP Cloud Platform and SAP Analytics Cloud are also working on this. Provided the implementation of Central Finance, Group Reporting will use this as the source of data. Group Coverage has a feature to produce “org units of consolidation” based on payment units. The balance sheet/currency conversion group method is defended and posted as manual newspaper registrations. It also has functions to remove payables/receivables etc. from the internal accounting are part of the features offered in community coverage. You can also create constructs for consolidation-specific master data. This element leverages a single source of truth “Universal Ledger.” More information about group coverage can be found here.

3. Integrations of third-party systems:

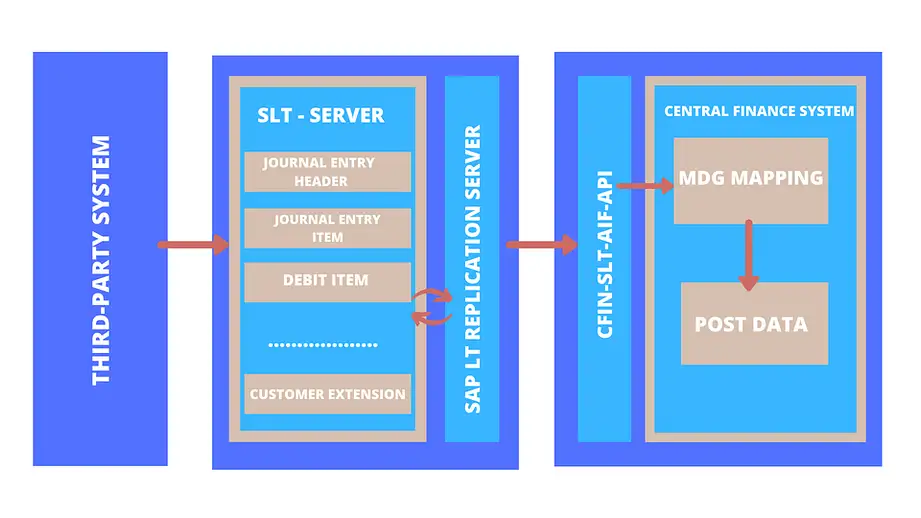

Transaction information from third-party systems may be used in a heterogeneous setting to build Central Finance documents. It helps the quarters of the Corporate Head to collect information for restructuring and team monitoring from SAP and Non-SAP platforms. This is usually accomplished through the use of an SLT architecture as shown in the figure below

ASSETS:-

- Propagation in real-time

- Single modernization source

- Reporting simplified