In past releases of SAP S4HANA 1610 in finance sector that had focused on real-time embedded software.It provides the new innovations and capabilities in SAP S4HANA 1610 allows the manufacturers to manage the embedded software with a product life cycle.The new product expanding very fast by the business with the feedback to the collected information pedagogical products,Mainly the requirements are based on design of the product,and absorbing the improvement of the product status Quality involving, outline as well as development progress.

The innovation with a SAP S/4HANA 1610 is undertaking the management arrangements and developed the portfolio with the extra components of SAP S4HANA, which emphasize the supporting venture and portfolio chiefs.SAP maid customer works simple and easy by providing the structure to engage Perfect adequacy.

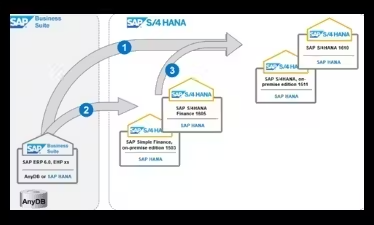

Mainly this post is all about the fundamentals of the latest Innovation of SAP S4 HANA in the field of Simple Finance. There are few variance with the typical FICO in R3 are discussed and added some of the features inthe simple finance 1.0in 2014

1.Single Source truth and all accounts become GL accounts

All the details are stored in the new table of ACDOCA it will not create any surplus,the total tables as all the measurements of GL,CO,ML,AA will be put away in ACDOCA.

ACDOCA has the GL multidimensional with a parallel currencies data files with a detailed information of 999,999. The new innovations in the 1610 release had solved the many issues with substances of various tables to display the reality and settle with a details stored in different tables of SAP.

2. Parallel Currency:

In IMG, our team maintains the currency layout for local currency as well as parallel currencies. We will manage maximum 3 currencies in a company code with parallel currencies,They are

- Company Code currency

- Group currency

- Hard currency

Parallel currencies also deals with the custom currencies as per the needs of the company. Parallel currencies also work for the outside countries for the business transactions. If we want to do international payments or receivables transactions, We must go on with parallel currency

Mainly custom currency is used by the company having subsidiaries in different countries. Custom currency can effect in area like

- General ledger

- Account Receivables and Payables

- Asset accounting

- Sales Area

- Material management area

- Controlling part

Parallel Currencies and Valuation

In the SAP S/4HANA 1610 release, the 10 parallel currencies for every record data can be attached together. With this latest innovation it is possible to divert all types of currencies in real-time, also 0 balance per document file is now confirms for every currency and the currency for the CO area is presently designed for all the records.

The parallel estimation functionality is now developed in the 1610 release. There are 2 ways which are offered in this release to store the frequent valuations.

1.Parallel valuation changed to the parallel single valuation record:

It provides a different record for each valuation, By including straightforward sub-division related to posting and reporting.

2.Parallel valuation rationalized in the multi-valued ledger:

It has an isolated quantity of parts in the similar record, accelerates the memory impression, effort and time required for closing.

3. Profitability Analysis in SAP S/4HANA 1610:

As the SAP S/4HANA Focus on the Upgrades and combination of record based COPA, it is easy to analyze profitability. The profitability in light of costing is as yet reachable and can be exploit as a part of parallel without any integration with the Universal Journal in ACDOCA table.

These are the upgrades in the account based profitability analysis:

- While advertising the merchandises issue, the split of costs of goods which is saled on several accounts is benefited.

- At the time of order agreement, the production possibilities on several accounts are split.

- The real-time inference of market segment information from cost posting should be possible.

- The Three new standard fields are offered during the details

Limitations of the account based profitability analysis:

- The sales situation are not supported which are not advertising to GL.

- The re-alignment of attributes is somewhat upheld, which are recifies in the wake of posting.

3.Bank Account Management (lite):

There were less house banks and bank accounts in SAP available in the old setup of bank account management. The latest version of SAP S/4HANA participates in the basic functions connected to the bank management functionality of cash management is involved in the core. This is known as Bank Account Management lite.

The innovative features and contrasts which are compared to the previous house bank and financial balance setup

- Group-wise account administration records

- Agreements(Signatory)

- Over-draft Constrain

- Opening and shutting with the approval process

- Easily guided bank accounts

The customers easy and able to maintain and manage the bank accounts with the help of a committed applications called Web Dynpro applications. The house bank can be customized by themselves in a easy way.The transaction of Fi12 is outdated now, which are removed by transaction Fi12_hbank. In this process, The procedure of creating the house bank and the house bank ledger are disconnected and can be implemented in two separate spots.

4. New Asset Accounting

It is a prerequisite to migrate towards the new asset accounting for transferring to S/4HANA Finance due to the following reasons:

- Resolution amongst AA and GL ensured

- No data redundancy

- A simplified outline of deterioration just 1 CoD

- No delta depreciation zones

- Asset balance in real-time

- Plan values in real-time

- No data idealness

Innovation in 1709 release in SAP S/4HANA Finance:

With the success of SAP S/4HANA 1610, the SAP S/4 HANA 1709 is released on September 15th 2017. It has many architectural advancements, contains the most recent tools which are available for SAP S/4HANA adoption as well as the functional inventions and improvements.The SAP S/4HANA 1709 Follow some fundamentals to executes on SAP HANA2, which is the 2nd generation of SAP’s in-memory database stage, which supports scale-out and utilization of active added presentation. The architectural developments describes about the clients to take the preferred outstanding point from the most recent developments in the database framework system.

In SAP S/4HANA 1709, the innovations in the financial field contains embedded analytics competences, developed in real-time accounting and closing competences, advanced cloud apps on the SAP cloud platform as well as the first machine learning outline for finance.

Let’s now explore the 5 major areas in the finance, which is released with SAP S/4HANA 1709:

1.Central Finance:

The first major location is the Central Finance, which contains an another Fiori app. This apps permits you to visit to the documents related the central financial position and also you can visit to the source document as well. In place of making transactions to each source system, it is easy to make the centralized payments as well as pass out centralized clearing tasks, this is possible by utilizing the central payment feature for SAP central finance. With An enhanced VAT configuration check for the company code is likewise included in the 1709 release, which gives you to trigger an improved check related to the taxes. It is required to utilize this check for the central payment.

The clients are seeing for a solution for the replication of costing-based CO-PA in central finance, in the SAP ERP Implementation foundation structure layout with respect to productivity based on account in SAP S/4HANA, which is not bolstered yet.

2.Financial Planning and Analysis:

In order to support new product cost analysis, the different new enhancements, for example, the SAP Fiori app are also delivering that support the financial planning and analysis. A work focus view is included in this, which not just allows the picture related to actual cost at work focus but it also provides the perfect data. Apart from this, some progress moments is succeed in the profitability analysis in Universal Journals. The spreading the cost of products retailed in SAP S/4HANA is improved and now a reporting app that indicates the re-alignment results are also brought out. These improvements help to provide a vibrant picture to the clients. These innovations mainly based on master data features and tags.

3.Accounting and Financial Close:

These innovation deals with the field of finance, which is separated into posting and reporting view. An introduction to the document splitting is now supporting according to the need of the customers. The SAP financial closing and accounting is a fundamental part of SAP S/4HANA 1709, in order to manage the speeder element close through meeting the supervisory prerequisites. The financial and accounting close supports in planning, executing, monitoring, and analyzing financial responsibilities for the objects within the group. A new system framework is given by the advanced compliance reporting, which helps to meet the acute compliance reporting requirements for the several accounting principles.

4.Treasury Management:

The different innovations and improvements are transferred within the treasury management, here are the list of them:

- Ongoing innovation of center treasury

- Stretched center treasury with value-added cloud management

- SAP payment management

- New functionality for treasury and cash management

- Upgraded currency hedgerow management

- Upgraded bank relationship management system.

The workflow functionality for the management of financial account is reformed, so that a new design of the workflow is now included, which further includes the new apps for processing and tracking workflow requests and a new app called Manage Workflows.

5.Financial Operations:

The financial operations in the SAP S/4HANA 1709 release contains four SAP cloud platform apps,

- SAP cloud for credit reconciliation,

- Customer payments for digital payments

- SAP cash application.

These apps support the end-to-end techniques by giving the cloud services. The enhanced incorporation of procedures between finance operations and the business network applications is also an added advantage, including

- Invoice and discount management

- Supply chain

- Cost center with SAP SuccessFactors Finance solutions

- Payment guidance with SAP field-glass solutions

Conclusion:

Thus, it can be Conveyed that the significance from the previous releases of SAP S/4HANA are still continuing in the latest innovation in 1610 and 1709 SAP S/4HANA Simple Finance, Containing the resolution and publicize of usually addressed competitive challenges in the field of reporting. These innovations make the Simple and easy Finance an appreciated addition to any business software infrastructure.